|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

The Average Home Loan Interest Rate: What You Need to KnowUnderstanding Home Loan Interest RatesWhen considering a home loan, understanding the average home loan interest rate is crucial. It can significantly impact the overall cost of your mortgage. Interest rates fluctuate based on various factors, including economic conditions and market demand. Factors Affecting Interest Rates

Learning about these factors can help you better prepare when discussing options with a lender. Current Trends in Home Loan Interest RatesRecent trends show that interest rates have been relatively stable but are subject to change. Keeping an eye on these trends can help you decide when to lock in your rate. Fixed vs. Variable Rates

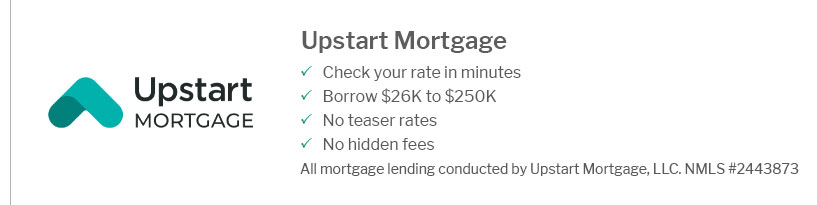

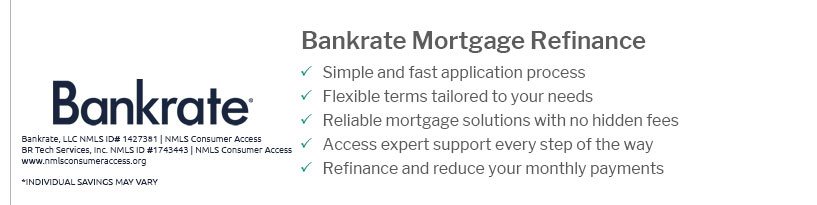

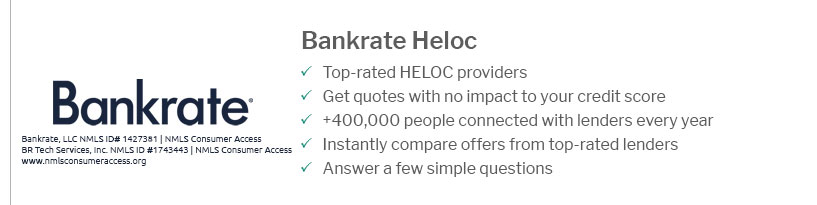

Choosing between fixed and variable rates depends on your financial situation and risk tolerance. For those interested in exploring more about loan types, you might consider looking into the best heloc rates in ct as an alternative option. How to Secure the Best Home Loan Interest RateSecuring the best interest rate requires preparation and research. Start by improving your credit score and understanding your financial situation. Finding a Good Mortgage LenderChoosing the right lender can make a significant difference in the rates you receive. It's essential to compare multiple lenders and consider their reputation and terms. For more guidance, check out finding a good mortgage lender. Tip: Always negotiate with lenders to potentially lower your interest rate. Frequently Asked QuestionsWhat is considered a good home loan interest rate?A good home loan interest rate is typically lower than the national average and suits your financial profile. Rates below 3% are generally considered favorable in a low-interest environment. How can I improve my chances of getting a lower interest rate?Improving your credit score, saving for a larger down payment, and reducing debt can enhance your chances of securing a lower rate. Are there any additional fees associated with home loans?Yes, home loans often include fees such as origination fees, closing costs, and sometimes prepayment penalties. It's essential to understand these costs before committing to a loan. https://fred.stlouisfed.org/series/MORTGAGE30US

View data of the average interest rate, calculated weekly, of fixed-rate mortgages with a 30-year repayment term. https://www.forbes.com/advisor/mortgages/mortgage-rates/

The average APR for the benchmark 30-year fixed mortgage is 6.77%. Last week. 6.74%. 15-year fixed-rate mortgage: Today. The average APR on a 15-year fixed ...

|

|---|